tax avoidance vs tax evasion south africa

Tax Evasion is illegal. An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting.

Hmmm Yoshi Committed Tax Fraud Tumblr Funny Funny Jokes Funny Posts

By News Room.

. Avoidance with the additional risk bearing caused by tax evasion either being a special case of this technology or one aspect of the cost of changing behavior to reduce tax liability. Tax Avoidance is legal. Businesses avoid taxes by taking all legitimate.

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 164 Fares RAHAHLIA News 164 Fares RAHAHLIA. First tax avoidance or evasion occurs across the tax spectrum and is. 2 impermissible tax avoidance.

Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven. Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

Basically tax avoidance is legal while tax evasion is not. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa. Tax Evasion VS Tax Avoidance.

Tax Avoidance vs Tax Evasion. Africa Africas problem with tax avoidance. Tax avoidance is organizing your undertakings with the goal.

Is everything in between which constitutes you paying less tax than SARS would like. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Tax evasion refers to illegal activities deliberately undertaken by the taxpayer to free themself from.

While tax evasion was generally regarded as an illegal. Below we briefly explain the difference between tax avoidance and tax evasion. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property.

Tax Avoidance vs Tax Evasion Infographic. Acts need not fit under the taxing rules. The South African Revenue Services SARS crackdown on non-compliant taxpayers in recent months is well.

Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance. And 3 legitimate tax planning or. View Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair sharepdf from FIN FINANCIAL at University of South Africa.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax Avoidance vs Tax Evasion. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in.

Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. Tax avoidance is on the face of it lawful and some would even suggest that an individual is.

Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. 91621 1050 PM Tax evasion vs. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway.

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. THE DIFFERENCE BETWEEN TAX AVOIDANCE AND TAX EVASION TAX JANUARY 30 2015 ADMIN Tax avoidance is generally the legal exploitation of the tax regime to your own. In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the.

Tax Evasion Statistics 2022 Update Balancing Everything

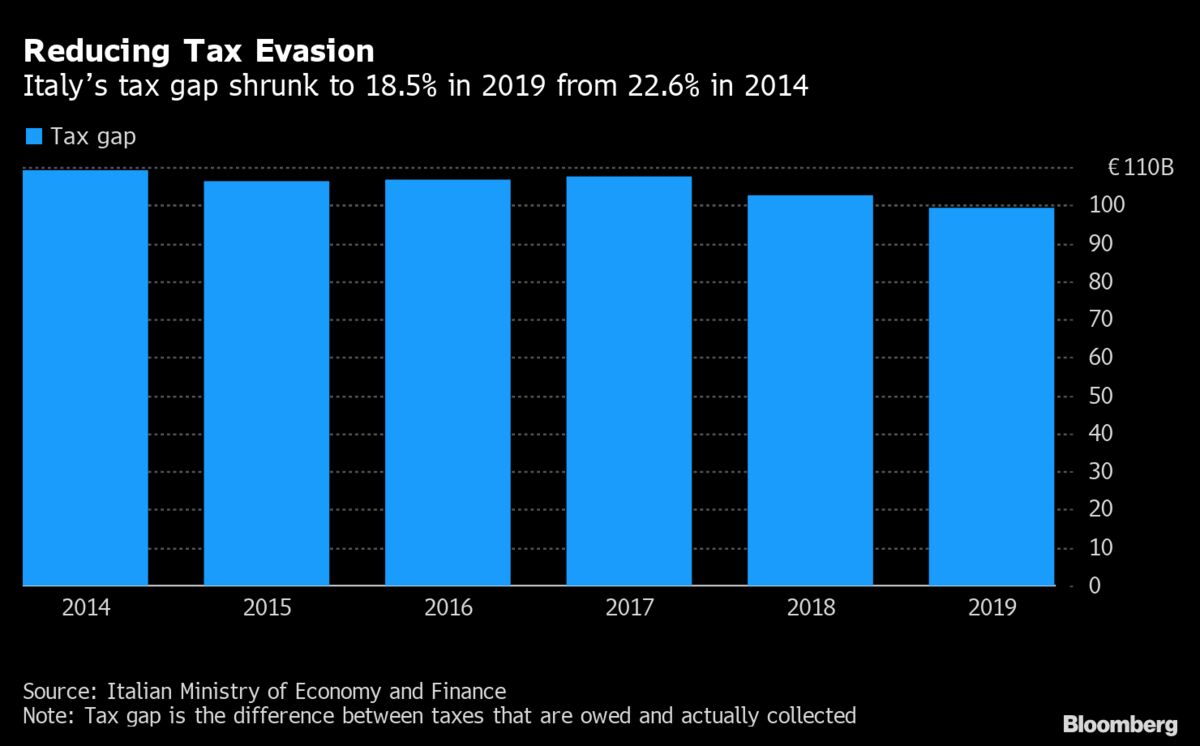

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion And Inequality Microeconomic Insights

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

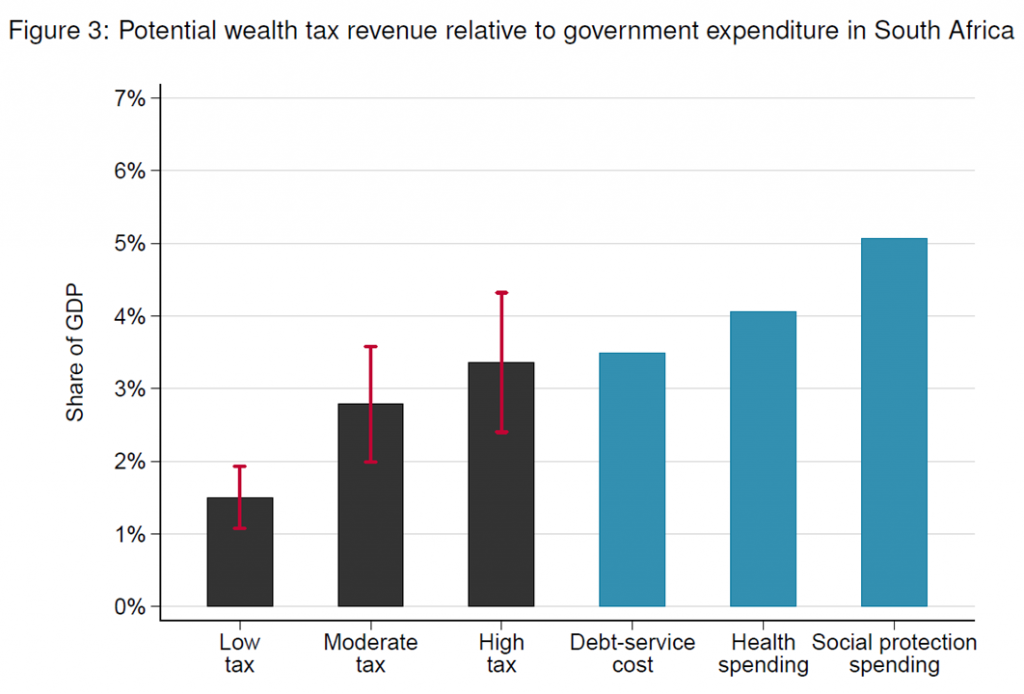

A Wealth Tax For South Africa Wid World Inequality Database

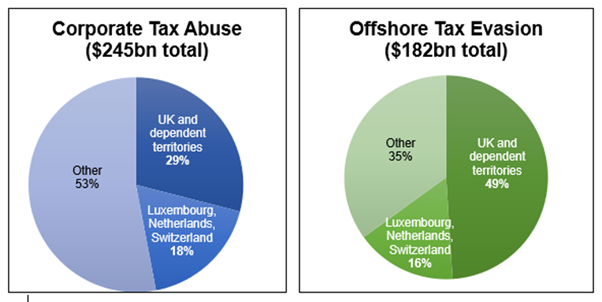

427 Billion Lost To Tax Havens Every Year Global Alliance For Tax Justice

The State Of Tax Justice 2021 Eutax

Estimating International Tax Evasion By Individuals

Tax Evasion And Inequality Microeconomic Insights

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Unu Wider Blog How Global Tax Dodging Costs Lives