oklahoma franchise tax instructions

The franchise tax applies solely to corporations with capital of 201000 or more. If a taxpayer computes the franchise tax due and determines that it amounts to 25000 or less the taxpayer is exempt from the tax and a.

Corporation Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

A ten percent 10 penalty and one and one-fourth percent 125 interest.

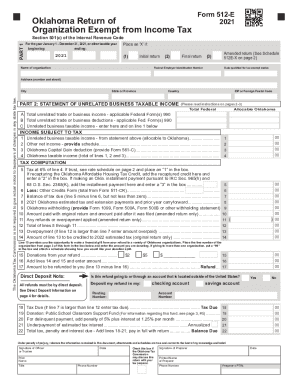

. In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000. Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Fill Online Printable Fillable Blank 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free.

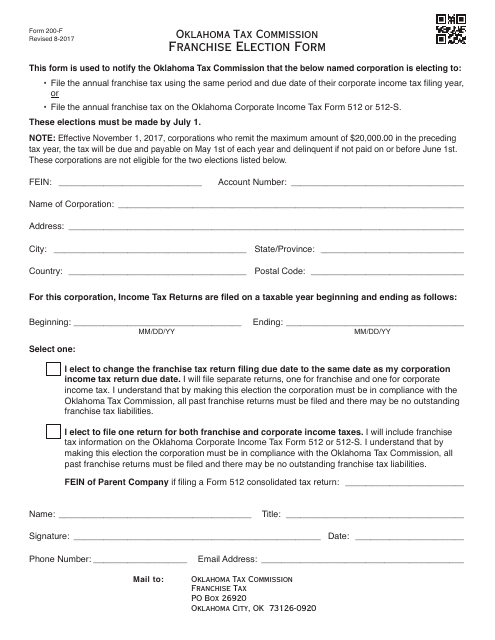

To make this election file Form 200-F. For purposes of filing 2013 franchise tax return all corporations are considered. If you checked Box Eindicate the changes only below.

Get and Sign Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022. Mine the amount of franchise tax due. Mail your return to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

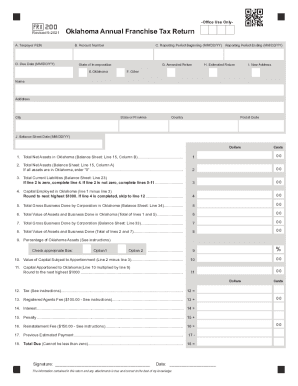

The state of Oklahoma requires all corporations nonprofits LLCs and LPs to file an Annual Franchise Tax Return Annual Certificate andor pay a Registered Agent Fee depending on what type of business you own. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A Revised 7-2008 Requirement for Filing Return Every corporation organized under the laws of this state or qualified to do or doing business in Oklahoma in a corporate or organized. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

The maximum annual franchise tax is 2000000. For a corporation that has elected to change its filing period to match its fiscal year the franchise tax is due on the 15th day of the third month following the close of the corporations tax year. Eligible entities are required to annually remit the franchise tax.

Interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Oklahoma Tax Commission all past franchise returns must be filed and there may be no outstanding franchise tax liabilities. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. To make this election a corporation must use Form 200-F Oklahoma Tax Commission Franchise Election Form Form 200-F to notify the Oklahoma Tax Commission OTC of its election to file its annual franchise tax along with its corporate income tax return.

Fiscal Year and Short Period Returns For all fiscal year and short period returns the beginning. Box 26930 Oklahoma City OK 73126-0930 Changes in Pre-Printed Information. Returns should be mailed to the Oklahoma Tax Commis-sion PO Box 26800 Oklahoma City OK 73126-0800.

I understand that by. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications. I elect to file one return for both franchise and corporate income taxes.

Best Treadmills On The Market Today 2020 6 days In FRx version 55 the default file name extension for generated reports to the Drilldown Viewer was frv or frz. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. Oklahoma Annual Report Service Filing Instructions When You Want More.

Maximum filers should complete and file Form 200 including a schedule of current If a. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma. Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Maximum filers should complete and file Form 200 including a schedule of current corporate officers and balance sheet.

Cor-porations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corpo-rate charter suspended do not qualify to file a combined income and franchise tax return. Income and Franchise Tax Forms and Instructions. Fill Online Printable Fillable Blank.

The report and tax will be delinquent if not paid on or before September 15. Once an election is made it is binding until a corporation submits a request to the OTC. Oklahoma Annual Franchise Tax Return Form 200.

2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 259 minutes to complete The 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains. Get and Sign Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022 Use a oklahoma form 200 2021 template to make your document workflow more streamlined. Time and Place for Filing Corporate returns shall be due no later than 30 days after.

Corporations reporting zero franchise tax liability must still file an annual return. Related Content - 200-2D Oklahoma Annual Franchise Tax Return- 2D Form. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two.

Oklahoma franchise tax is due and payable each year on July 1. Video instructions and help with filling out and completing frx 200. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999.

I will include franchise tax information on the Oklahoma Corporate Income Tax Form 512 or 512-S. Fiscal Year and Short Period Returns For all fiscal year and short period returns the beginning.

Oklahoma Form 512 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022

Otc Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return 2020 Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

ร บแปลส ญญา Law Firm Lawyer Family Law Attorney

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Jurassic Park Playing Cards Jurassic Park Jurassic Deck Of Cards

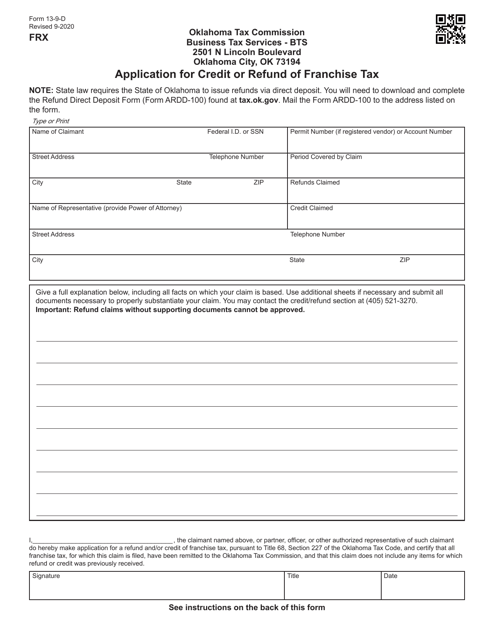

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Nc Taxes North Carolina Extends Tax Filing Payment Deadline To May 17 Abc11 Raleigh Durham

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Funny Godzilla Godzilla Franchise

Gst Suvidha Center Head Office Pune Income Tax Return Filling Accounting

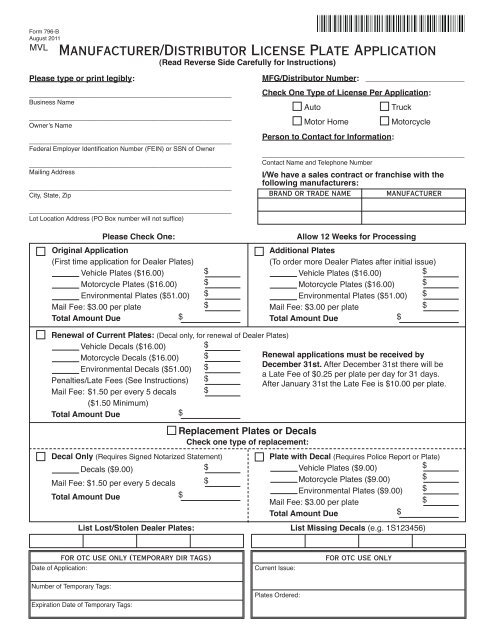

Manufacturer Distributor License Plate Application Oklahoma Tax

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return 2017 Templateroller